Relaunching the Tenants Purchase Scheme would benefit all

This article appeared originally in the CHINADAILY on 25 Feburary, 2021.

Author: Ryan Ip, Head of Land and Housing Research at Our Hong Kong Foundation

[Read the related report (Chi Only)]

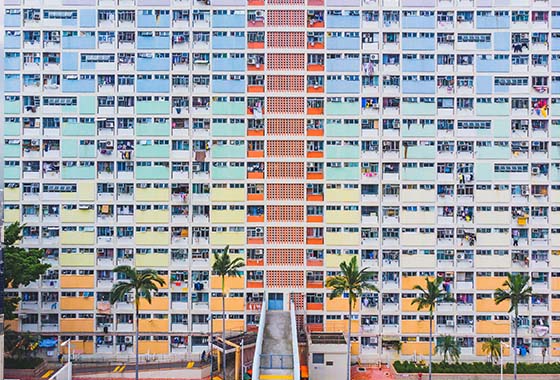

We recently visited two public rental housing (PRH) estates, Tak Tin Estate and Kwong Tin Estate in Lam Tin, where we conducted interviews with the residents. Although the two estates are located in close proximity to each other, they are not of the same type: Tak Tin is one of the 39 estates under the Tenants Purchase Scheme (TPS), while Kwong Tin, unfortunately, is not included in the program. When we asked how they feel about the TPS, residents of Tak Tin tended to use positive adjectives like “contented”, “grateful”, “fortunate”, etc., while the residents of Kwong Tin expressed disappointment and jealousy.

We do not feel surprised at all, as our research has shown that the TPS can generate a variety of benefits, including narrowing the wealth gap, generating overall wealth, relieving the government’s burden, and leaping forward to alleviate housing problems.

Not only does it allow the grassroots to become homeowners, it also generates additional revenue for the government, which could then be used to ease the negative economic impact brought about by the pandemic, enhance the competitiveness of Hong Kong and prepare the city for the challenges ahead.

The investigation revealed that the grassroots households, after being allowed to purchase their rented flats, dramatically narrowed the wealth gap. The sale of PRH units would help bridge the income gap.

As we all know, wealth disparity is a serious problem in Hong Kong. According to the Global Wealth Report published by Credit Suisse, Hong Kong’s richest 1 percent owns 53 percent of the city’s wealth. The crux of the problem is that Hong Kong’s homeownership rate has been hovering at 50 percent, but property prices have been soaring over the past decade, resulting in a widening wealth gap between the property owners and the propertyless.

The figure in 2019 revealed that private homeowners possessed on average 30 times as much wealth as PRH tenants on account of the gap in housing wealth alone, which was the largest since 1997. The result reflects that no matter how hard the propertyless work, the increase in their income and savings would never keep up with the rise in property prices. Relaunching the TPS would, however, provide 800,000 PRH sitting tenants (about 30 percent of all households in Hong Kong) with the opportunity to buy their own flats at an affordable price, making it possible for the deprived population to share the gains of asset appreciation.

When a substantial portion of the propertyless enjoys asset appreciation, the potential value of public housing will be unleashed to create wealth for all.

Relaunching the TPS is estimated to create up to HK$4.4 trillion (US$516 billion) in the form of newly generated wealth, which is equivalent to generating around HK$600,000 per capita in the city. In fact, the current practice of renting out units to low-income families is inefficient. On the one hand, the value of PRH flats would remain insignificant to the sitting tenants if they could not sell the flats. On the other hand, the monthly rental income received by the government is insufficient to cover the construction and maintenance costs of PRH units.

However, if all the PRH flats become freely tradable on the open market, around HK$4.4 trillion of land value could be released, which is equivalent to 155 percent of GDP in 2019 — a huge amount of wealth that exceeds Hong Kong’s entire foreign exchange reserves.

The program could significantly reduce the government’s financial burden, and the savings could be used to improve the social security system. Due to the considerable costs of constructing and maintaining PRH units and the fact that their rents are far below the market rate, it is estimated that the government would have to provide a subsidy of HK$2.4 million for each unit at the current price.

Assuming each unit is priced at HK$2 million, just by selling half of the existing units (about 400,000 in total) would yield HK$800 billion, which is equivalent to the whole of the government’s fiscal reserve. This would be a timely boost for government finances, considering the impact of the COVID-19 pandemic on our economy and an annual budget deficit of HK$258 billion. Moreover, the money could be used to construct more public housing buildings, strengthen social infrastructure, enhance the education system and improve social security system, among other benefits.

Besides the improvement of the SAR’s financial status, relaunching the TPS would also allow the city to use its resources in an efficient way, which, in turn, would alleviate the choking housing shortage in the short to medium term. The TPS is expected to maximize the utilization of public housing resources. An empirical analysis has found that the average household size is 3.4 among TPS owners, while that of PRH flats only stands at 2.9. Ideally speaking, if all existing rental units were sold, an additional 160,000 individuals could be accommodated without building any new units. This efficiency would immediately boost the housing supply by about 60,000 flats, which is approximately the total number of units built in the previous three years.

The TPS deserves the SAR government’s serious consideration. The four favorables listed above prove that relaunching the TPS is a solution with multiple benefits. Not only does it allow the grassroots to become homeowners, it also generates additional revenue for the government, which could then be used to ease the negative economic impact brought about by the pandemic, enhance the competitiveness of Hong Kong and prepare the city for the challenges ahead. We therefore sincerely hope the government would reconsider the proposal seriously.