Our Hong Kong Foundation Launches New Research Report on

Brownfields and Logistics Industry Development

The Emergence of Brownfields is Not Without a Cause

Timely Support is Required for the Development of the Logistics Industry

(28 July 2020, Hong Kong) Our Hong Kong Foundation (OHKF) has released a new research report today on Land and Housing policy entitled Strategic Land Development for Jobs: From Brownfields to Modern Logistics. The report indicates that an absence of long-term development plans for Hong Kong’s logistics industry, coupled with insufficient investment in infrastructure, has led to the gradual loss of the competitive edge of our logistics industry. In addition, the continual shortage of ancillary land to support the logistics industry has left operators with no choice but to rent vacant agricultural land in the New Territories for their operations, leading to the emergence of the so-called ‘brownfield’ sites.

To ensure the sustainable development of Hong Kong's logistics industry, the Government should provide comprehensive policy support in the areas of ‘hardware’ and ‘software’ respectively, including the development of logistics nodes at four strategic locations, and developing transport infrastructure that connects to each of the logistics nodes; formulating industrial policies and establishing a statutory body that dedicates to the development of strategic industries.

Hong Kong's Logistics Industry is Losing its Competitive Edge and is Falling Behind Singapore

The trading and logistics industry is one of the four key industries in Hong Kong, accounting for 21.2% of GDP and contributing 18.6% of employment to the city. Its importance is self-evident.

Driven by changes in production and consumption patterns, the logistics industry is playing an increasingly important role in the global supply chain. On the one hand, products are made by manufacturers in different countries, making logistics an essential link connecting various processes. On the other hand, the boom of ecommerce in recent years has gradually migrated consumption activities from offline to online, which particularly relies on logistics services to deliver goods directly to buyers’ homes.

Hong Kong has numerous advantages as a traditional logistics hub, including strategic location, excellent connectivity, efficient customs, and free port status. Our logistics industry is, however, losing its edge due to insufficient government support and a lack of long-term planning, which resulted in scant policy support and persistent shortage of land supply.

Hong Kong ranked 12th in the World Bank's 2018 Logistics Performance Index, down three places from 2016, and lagged behind our main rival Singapore. Looking at Government’s planning studies in the past, as early as the 1990s, the Government had already planned to develop areas in Tuen Mun West and Hung Shui Kiu into back-up land to support maritime and port industries. Unfortunately, these plans had not been implemented in a systematic manner. The previous plans of Container Terminal 10 and Siu Ho Wan Logistics Park, which were intended to support development of the local logistics industry, were also abandoned in the end.

Over 40% of Port Back-Up Land Around Kwai Tsing Container Terminals is Under-Utilised

OHKF's analysis showed that among the world's top ten ports, the Hong Kong Port came last in terms of yard-to-throughput ratio. The problem of limited yard space is further exacerbated by the growing share of transshipment business in the Hong Kong Port. In addition, according to our analysis, over 40% of land designated for port back-up uses around the Kwai Tsing Container Terminals is currently underutilised. Although the Government conducted long-term land use planning for some of these sites five years ago, most of the plans have not been implemented so far.

Undersupply of Logistics Space Forced Operators to Relocate to Brownfield Sites in the New Territories

In fact, the supply of logistics space is far from adequate to meet the industry’s demand. While the trading and logistics sector's GDP contribution grew by 51% from 2009 to 2018, built-up industrial land in Hong Kong recorded only a meagre increase of 8%. In the past decade, there was even a supply vacuum of private storages, pushing down vacancy rates and driving up rents for facilities. On the other hand, the existing design of flatted factories cannot serve the needs of modern logistics industry, as logistics operators are looking for modern facilitates with large floor plates, high ceilings, and direct ramp access to all floors.

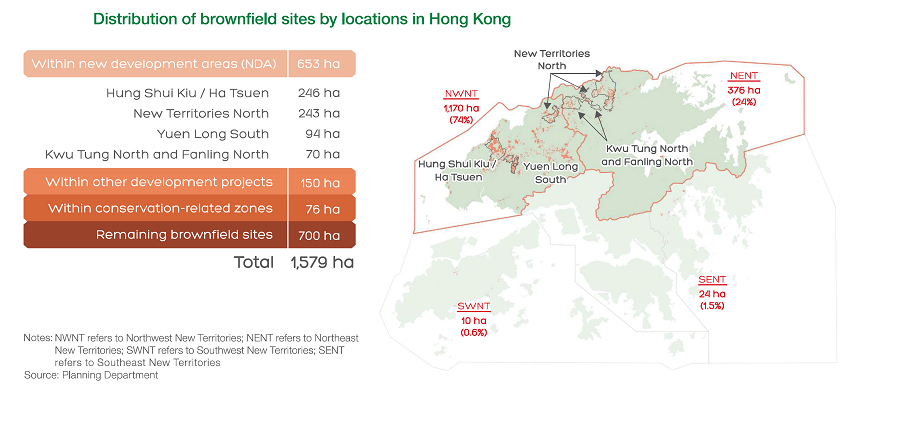

Due to the undersupply of industrial space, logistics operators are pushed to look for affordable alternatives in the New Territories, forcing them to operate on sites that lack proper planning and facilities, which leads to discontent over brownfield sites in the society. Currently, 46% of the 1,414 hectares active brownfields are supporting the operations of logistics-related industries. In the future, with the implementation of New Development Areas and other development projects in the New Territories, many brownfield sites will gradually be phased out. OHKF estimates that 390 hectares of brownfield sites will be reapportioned for housing and other uses by 2030, therefore land supply for logistics and other industries will experience negative growth.

OHKF believes that there is not only a lack of residential sites but also a continuous shortage of various types of land in Hong Kong, including land for supporting various industries and employment. In the long run, the Government must plan well, take concrete actions to increase land supply on a large scale and provide adequate transport infrastructure. Only by doing so can we meet the housing needs of the public while ensuring sufficient land is available for the development of different key industries.

The Government should provide timely solutions for the sustainable development of the logistics industry. Therefore, OHKF puts forward five policy recommendations from both the ‘hardware’ and ‘software’ perspectives.

Hardware

Recommendation 1: Develop Dedicated Logistics Nodes

In anticipation of the future demand of the trading and logistics industries and other strategic industries, the Government should develop dedicated logistics nodes in the New Territories, so as to eliminate negative environmental impacts generated by unorganised brownfield operations, and to support the relocation of current brownfield operators in a well-planned manner, thereby facilitating the reapportioning of brownfield sites for other developments such as housing.

Therefore, OHKF proposes to build four logistics nodes at strategic locations in the New Territories. The first location is the Hong Kong Boundary Crossing Facilities Island, which is adjacent to the Hong Kong International Airport and located at the landing point of the Hong Kong-Zhuhai-Macao Bridge. It serves as a double gateway that connects with both the Greater Bay Area and the world. The second location is Lung Kwu Tan and Tuen Mun West, where the soon-to-be commissioned Tuen Mun Chek Lap Kok Link will connect to the airport, and the proposed Tuen Mun Western Bypass will connect with the Northwest New Territories, making it an ideal location for airport logistics ancillary land. The third location is the Northwest New Territories, which is the landing point of the Kong Sham West Highway. It can become a distribution centre for ‘West in-West out’ logistics between Shenzhen and Hong Kong. The fourth location is the New Territories North, where the soon-to-be opened Liantang/Heung Yuen Wai Boundary Control Point will open access to the Shenzhen East Expressway, thus it can serve as another node for‘East in-East out’road transport.

The strategic locations of the above mentioned logistics nodes will enhance the connectivity of the Hong Kong logistics industry with the Greater Bay Area and the world. They can provide up to 930 hectares of industrial land and accommodate around 125,000 jobs in logistics-related industries such as air freight, e-commerce, and port back-up. The key to the development of the above logistics nodes is the provision of relevant supporting infrastructure such as roads and railways, including the P1 Road, the Tuen Mun Western Bypass, the Route 11, the future road linking to the artificial islands in the Central Waters, as well as the new cross-sea railway.

Recommendation 2: Reform Site Allocation Mechanism

To ensure the land inside these logistics nodes are allocated fairly to users, including small and medium enterprises and brownfield operators, the OHKF recommends that the Government should rethink its site allocation mechanism within the aforementioned logistics nodes, instead of succumbing to the old path of open bidding to achieve the highest profit for the sites. OHKF also suggests that the logistics nodes should be managed by a dedicated statutory body that can facilitate the upgrade and transformation of the industry.

Recommendation 3: Relocate Kwai Tsing Container Terminals

OHKF’s 2017 report From Large Scale Reclamation to an Ideal Home has proposed to relocate the Kwai Tsing Container Terminals to an artificial island located in Cheung Chau South, away from the urban area. Some experts have also proposed building a mega port on a Southwest island outside Hong Kong waters. Relocating

the Terminals can create an opportunity to upgrade and modernise our port infrastructure, which can enable the establishment of a modern port like the Singapore's Taus Mega Port and the Shanghai's Yangshan Port, and thereby consolidates all major ports in the Greater Bay Area.

The relocation of the Kwai Tsing Container Terminals will also free up valuable land in the urban core area. The Kwai Tsing Container Terminals, together with the surrounding industrial sites and the Government's proposed reclamation of Tsing Yi South, render a combined area of nearly 790 hectares. They are located at the heart of urban areas with well-developed traffic network, and are suitable for residential and other uses to meet the city’s economic development and livelihood needs.

Software

Recommendation 4: Conduct Economic Reviews and Formulate Industrial Policies

In the absence of regular strategic economic reviews and industrial blueprints, there is a lack of coordination across departments within the Government on policy support for various industries. In contrast, Singapore convenes Economic Review Committee every 10 years to deliberate future economic development strategy and formulate industrial blueprints.

Therefore, OHKF suggests that the Government should conduct regular economic reviews and devise industrial policies to facilitate the growth of strategic industries, such as logistics. A clear economic strategy and industrial blueprint will provide straightforward guidance for land use planning, so that the land demand of our strategic industries can be fulfilled in a timely and orderly manner.

Recommendation 5: Establish a Statutory Body for the Development of Strategic Industries

OHKF recommends that the Government should establish a statutory body which is dedicated to the development of strategic industries such as logistics. While the sector already has a number of advisory bodies, they are mostly consultative in nature and lack the necessary resources and administrative power to implement suggestions put forward by the industry at policy level.

The Government may consider upgrading or consolidating the Hong Kong Maritime and Port Board, the Hong Kong Logistics Development Council, and the Hong Kong Trade Development Council into a statutory body dedicated to the development of strategic industries, thereby facilitating the sustainable development of the logistics and other strategic industries. A new statutory body with powers to develop industrial properties and independent financial resources would be more effective in promoting the development of our industries.

Mr Stephen Wong, Deputy Executive Director and Head of Public Policy Institute of OHKF, remarked that: ‘The coronavirus pandemic and growing geopolitical tensions have transformed the trading and supply chain landscape in the world today. In order to respond to the evolving situation, the Government should face up to its responsibilities and act in a timely manner in the overall interests of the society and the industry, thus helping Hong Kong to maintain our indispensable role in the global trade and logistics arena.’

Mr Ryan Ip, Head of Land and Housing Research of OHKF, highlighted: ‘People not only yearn for comfortable homes, they also aspire to better careers. While the Government should spare no effort in unlocking more land for housing, it should also ensure that sufficient land is available for the development of Hong Kong's strategic industries. We need forward-looking industrial policies and long-term land use planning, as well as timely provision of adequate land and facilities for strategic industries such as logistics, so as to support the sustainable development of our industries and create job opportunities.’

Full report of Strategic Land Development for Jobs: From Brownfields to Modern Logistics:

Chinese version: https://bit.ly/3hFltul

English version: https://bit.ly/2CPP0Tl

Distribution of brownfield sites by locations in Hong Kong

One of the proposed logistics nodes at Lung Kwu Tan and Tuen Mun West:

Watch the video: https://youtu.be/nSzd_bgkGXE

Strategic Land Development for Jobs: From Brownfields to Modern Logistics report launch:

Virtual press conference: https://youtu.be/oU3JUH94puA?t=283

%20800.jpg)

%20800.jpg)